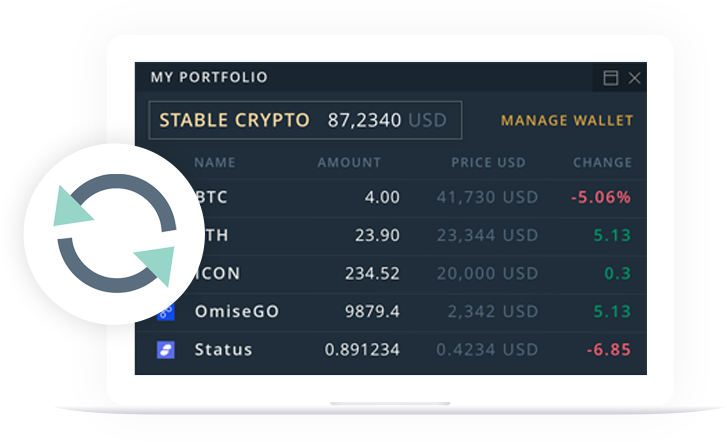

Made Up Of Liquid Cryptocurrencies

The Darico Index Fund is a basket of upto 10 of the most liquid cryptocurrencies available in the market. Each token is selected as a result of detailed risk analysis.

Weekly Portfolio Rebalancing

We monitor, analyse and rebalance our portfolio of cryptocurrencies on a weekly basis, to ensure that we are constantly and consistently achieving an optimal level of profitability.

Quarterly Portfolio Restructure

To ensure peak performance for our portfolio we will undertake an in depth analysis following each quarter. If necessary the prortfolio will be restructured based of the findings of the quarterly review.